For many novice traders, reading stock charts can seem like deciphering a foreign language—nearly impossible without proper context. But in truth, a lot of what you see in stock charts can be broken down into digestible and intuitive trends and patterns.

Stock charts, at their core, help you see how well a public company’s shares are performing. The chart goes up and down based on the supply and demand of these shares.

When zoomed out, the stock chart represents share prices running along the Y-axis over a specified period, which runs along the X-axis.

That said, stock charts come with a whole array of patterns and chart types. These charts also come equipped with tools that measure different indicators that investors can use to predict future price movements.

Understanding the anatomy of a stock chart, as well as the inner meanings behind the different movements and patterns, can give you an advantage in making the right investment decisions for your financial benefit.

If you’re looking to increase your stock chart knowledge, we got you. This article will lay down all you need to know to read and analyse stock charts with confidence.

Let’s jump right into it.

What is a Stock Chart?

A stock chart is a graphical representation of a stock’s price performance over a set period. The movements show the fluctuations in the stock price, allowing investors to quickly analyse and visualise trends and patterns that shape the stock’s performance.

Armed with this knowledge, investors can make informed decisions on whether to purchase, hold, or sell a certain stock.

Stocks aren’t the only financial goods that can be represented by charts—exchange-traded funds (ETFs), commodities, forex rates, bonds, cryptocurrencies, and many other financial vehicles can also have their performance assessed using these charts.

Some charts can also display additional information like technical indicators, price volatility, and trading volume, which can provide even more information on a stock’s performance. This stock information allows traders to gauge whether their investment decisions follow sound, by-the-book principles.

3 Main Types of Stock Charts

There are several types of stock charts in the trading world, ranging from simple to complex. Among these types, there are three that stand out as the most popular and commonly used.

These popular charts are the ones you should look out for and prioritise understanding in your journey to becoming a more informed investor.

You’re more likely to come across them than any other stock chart type in stock exchange websites and the like, so it’s in your best interest to familiarise yourself with them and work on absorbing the rest later on.

These popular stock chart types are the following:

1. Line Charts

One of the most simple and intuitive stock charts you can encounter is the line chart. The line chart connects a series of closing stock prices over time and creates a visual line to represent it, framing the day-to-day changes of stock price movements in a given time frame.

A line chart is a great first glimpse of stock charts because of its intuitive nature—its movement trending upwards indicates a bullish price movement, which is favourable to stockholders. Conversely, a downward trend suggests a bearish price movement, which is more favourable to buyers.

As useful as this stock chart is, a line chart lacks crucial data points like opening, high, and low prices of a given period. This makes it better for long-term investing rather than short-term, as short-term investors can’t see the historical movements of the price during the day or period in the graph.

What a line chart lacks in detail, it makes up for in easy visualisation. It offers a clean and minimalistic view of stock trends, removing the clutter of price indicators and helping traders spot price action very quickly. This chart is among the best to utilise for long-term investors who want to be given information in a straightforward manner.

2. Bar Charts

Bar charts are another way to track stock price movements over time. With it, traders can see a price range per period, with a vertical strip (the bar) increasing or decreasing based on the upward or downward movement of the stock respectively.

High swings of volatility will mean a larger bar since it indicates a large price movement. Conversely, more compact price action will decrease the size of the bar.

Bar charts hold more information than line charts. In particular, it has both the high and low prices of the specified period per bar. These are represented by horizontal lines on the left and right of the bar, with the left side being the opening price and the right line being the closing price of the stock.

3. Candlestick Charts

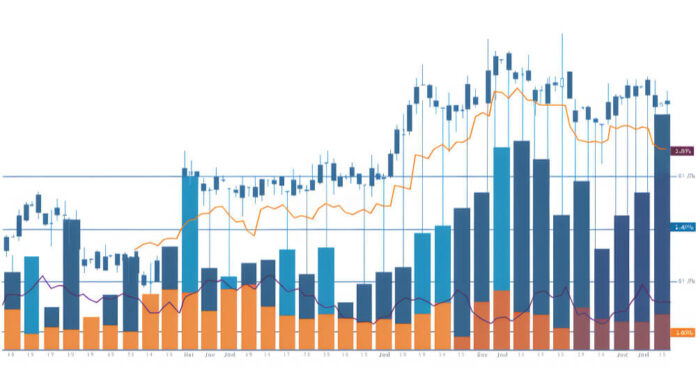

Candlestick charts show open, closed, high, and low stock prices in a candlestick-like format.

The shape of a candlestick consists of a body, which shows the range of opening and closing prices. It consists of a wick, which can be found below and above the body to indicate the highest and lowest price during the period.

It also comes with one of two colours: red, which shows that it closed below the previous opening price, and green, which shows that it closed higher than the previous opening price.

Candlestick charts are excellent for making trend analyses due to the information they provide traders in the short term. It’s also visually intuitive, which means it comes with all the benefits of the previous charts while still packing a fairly informative punch.

Bonus: Other Charts

Besides those aforementioned types of stock charts, there are a few more stock charts you may encounter.

The Heikin-Ashi chart is one such chart, which uses a modified formula to smooth price action and highlight more accurate trends.

The Renko chart is another type that focuses on price changes and not time and volume.

Tick charts are easier for day traders since they plot price movements based on the number of trades rather than time intervals.

In any case, different charts can be used for different trading strategies—and the three highlighted in their separate sections above are generally the best ones to analyse for first-timers.

Elements of a Stock Chart

Now that you’re familiar with the different chart types, it’s time to understand the details you can encounter when attempting to read a stock chart.

These are some of the most prominent elements of a stock chart:

- Price movements: The core component of a stock chart is the upward and downward movement of the stock price, over a specified time. The final price reflects present stock performance. You can typically find this information on individual stock pages, such as the CSL Limited share price.

- Volume: The stock volume shows how many shares are traded during a period. When high, it signals high market interest, and when low, it shows increased liquidity and lower demand.

- Timeframe: This refers to the time that it takes for a trend to last in the stock market. This can be adjusted to be minutes, hours, days, weeks, months, a year, or multiple years.

- Support and resistance levels: These levels are predictors that stock prices tend to fall between. A support level is the stock price the current minimum price buyers buy the stock, while a resistance level is the minimum stock price that sellers are willing to sell the stock.

- Technical indicators: Some stock charts are equipped with tools that can help create a comprehensive technical analysis assessment. These indicators can provide insights into a stock’s price trends and volatility, which can be used to make interpretations on readings like moving averages, relative strength index, and Bollinger bands.

How to Use Stock Chart Data to Make Better Investments

To become a better stock chart reader, you have to use all the information at your disposal to assess and predict a stock’s future outcome.

This means being knowledgeable in the charts and knowing how to make general assessments as well.

Publicly-listed businesses that perform well and deliver excellence on all fronts are likely to achieve positive market sentiment.

This, when coupled with an upwards-trending movement, can help you uncover optimal entry points and maximise your profit potential for that given stock.

An effective and savvy trader uses all the data points above to craft strategies that can give them an upper hand when making investments, whether it’s in the short-term or the long-term.

They’ll need to know how to read charts, identify their parts, and make a strategy that’s based on these data points, such as support and resistance levels and technical indicators.

In doing this, you’ll be more likely to attain success in your trading journey. Good luck trading!